Fast simple UPI collections for growing teams

Give your users an easy way to pay. Scan a QR open their UPI app with intent or set a mandate with AutoPay. You get instant confirmations real time status and smooth reconciliation.

- QR payments. Static and dynamic.

- Intent and collect flows supported.

- UPI AutoPay for repeat payments.

- Live status with webhooks.

- VPA verify to cut fails.

- Simple refunds and dispute flow.

Transakt

How UPI Collection helps your team move faster

Real time status for every payment

Give customers a smooth checkout with QR intent deep link and collect. Each payment confirms in seconds with a reference you can track end to end. Your support team sees the same status your dashboard shows, so there is no back and forth.

We verify the VPA before the request goes out. Payments auto match to the right order and we update the status as it changes. Settlements follow a clear schedule and exports drop straight into your books. Your team spends time on growth, not chasing entries.

Your partner for smooth UPI launches

Work with a team that does UPI all day. We set up QR intent and collect, enable AutoPay, and tune the flow so it feels smooth from day one. You get clear docs, quick answers, and simple SLAs. We watch jobs and alerts in real time and keep things steady as you grow.

what you get

What you get with UPI Collection

UPI Collection brings every common UPI payment mode into one clean flow. Your product team gets simple APIs and a clear dashboard.

Customer onboarding and profiles

Create customer profiles from the dashboard or by API and keep only the fields you need. We check the UPI ID before a request goes out so you avoid failed attempts and pointless support loops. Add tags for product or region and share access with roles for your team. Run quick tests in the sandbox, confirm webhook events, and move to live with a short checklist. Clear logs show who did what and when, so audits are simple and launch days stay calm.

Payment flows you can mix and match

Offer the modes your users know. Show static QR at counters or generate dynamic QR with amount and order reference. Add intent on your site or app so a user jumps to their UPI app with one tap and returns to your screen after pay. Send a collect request from your back end when you want an approve inside the UPI app. For repeat bills turn on UPI AutoPay so users set and manage a mandate with full control. We stay aligned with NPCI guidance for these flows.

Settlement and reconciliation

Track every rupee from payment to settlement with clear references that map to your orders. The dashboard and webhooks share the same live truth, so your system updates in real time. Choose the right settlement schedule and export neat reports that include fees, taxes, and refunds. If you link connected banking we can pull statements and match entries for you which cuts manual work and mistakes. Alerts flag any outlier so month close remains quick and drama free.

Refunds disputes and support

Fix problems without noise. Raise full or partial refunds from the dashboard or by API and we update status through webhooks so your system reflects the change at once. If a payment sits in pending we keep watching and post the final result when the bank confirms it. For subscriptions you can pause or cancel a mandate and send a clear notice to the user. A step by step dispute flow with evidence notes keeps your team focused while we help you meet timelines. (Autopay mandates are user controlled as per NPCI.)

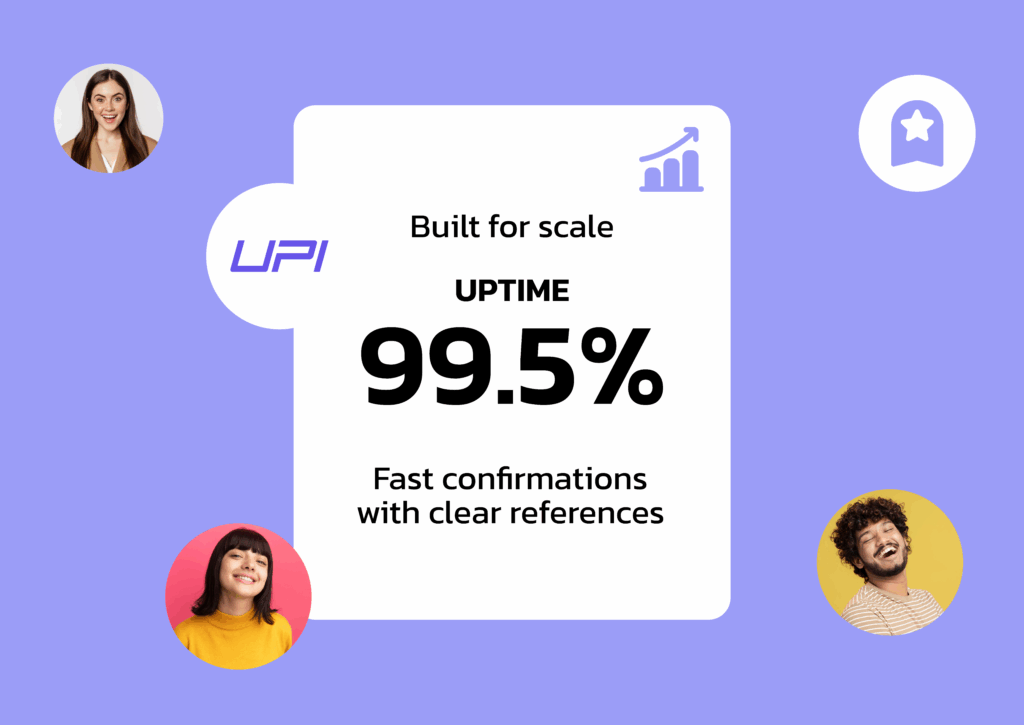

THE PROOF IS IN THE NUMBERS

Numbers that matter for your UPI flows

99.9%

Payment success across leading UPI apps.

Runs on real time NPCI rails for instant confirmation.

07 sec

Typical time from request to final status. UPI is an instant account to account system, so customers see quick updates.

₹ 264 Cr +

Total collected across QR intent collect and AutoPay. Covers all common UPI modes including recurring mandates.

FAQ

FAQs about UPI Collections

Quick answers to common questions about setup security and day to day use.

Start with intent on app and mobile web, and dynamic QR on regular web. NPCI asked acquirers to move app and mobile web to intent and keep web flows on dynamic QR rather than collect. This gives faster handoff and clearer status. Add collect only when you really need a request to pay flow.

Users approve a one time mandate inside their UPI app. After that, payments run automatically on the set schedule. As of NPCI guidance, typical mandates go up to fifteen thousand rupees, with higher caps for a few merchant categories. Users can pause modify or revoke a mandate at any time. Keep a clear cancel option in your product.

Pending usually clears to success or fail after the bank confirms. If it finally fails, user funds reverse within standard timelines. You can raise refunds from your system once a payment is successful. For disputes and chargebacks, follow the UPI dispute flow and reply within timelines set by NPCI. Keep references handy for quick evidence.

Yes. Verifying the VPA before you send a request helps avoid misdirected payments and cuts support work. Many providers expose a simple verify endpoint that confirms the handle and often returns the name on record. Use it at checkout and during customer setup.