Finance clarity that pays off

Connected Banking gives your team one clean view of cash across banks. Pull statements on demand, match settlements with a click, and cut the busy work from reconciliation. Faster close, fewer surprises, stronger control.

- Live balances from many banks

- Scheduled and on demand statement fetch

- Smart match for UPI collections payouts and BBPS

- Account verification before you move money

- Alerts for low balance and failed fetch

- Clean exports and webhooks to your system

Transakt

How Connected Banking helps your team move faster

Bank visibility with smart reconciliation

Bring every account into one clean view. See balances, pull statements, and track settlements for UPI, payouts, and BBPS without jumping between portals..

Set simple rules for fetch schedules and alerts. We match inflows and outflows, flag gaps, and give finance clear files for accounting. Your team spends time on decisions, not downloads.

Experienced team for bank integrations

Work with a team that lives and breathes bank connectivity. We set up accounts the right way, keep connections stable, and monitor fetch jobs so your finance team does not chase files. Clear SLAs and quick help when you need it.

what you get

What is included in Connected Banking

You get a clear view of money across banks plus tools that make reconciliation simple and fast. Here is what comes in the box.

and setup

statements

settlement tracking

audit trail

and setup

Account linking and setup

Connect your bank accounts through a secure flow that your finance team can follow without help from engineering. Choose the banks you want, verify access, and select the accounts that matter for daily work. We show what data each bank can provide, such as balances, statements, and settlement files, so there are no surprises later. Set your first statement fetch with a simple schedule and run a dry run in the sandbox to see real results with sample data. Invite teammates with the right access from day one, and keep owners in control with easy approvals. The goal is a clean start with zero guesswork.

statements

Balances and statements

Get a live view of cash across all linked accounts in one place. See today’s balances by bank and by account, then pull statements for any date range without logging into separate portals. You can set a daily or hourly schedule, or fetch on demand when you close the day. Statements arrive in a consistent format, which means less time cleaning files and more time making decisions. You can filter by account, by product line, or by partner. When a bank cannot return data, we show a clear reason and a next step, so your team never waits in the dark.

settlement tracking

Reconciliation and settlement tracking

Match collections and payouts with bank entries in a few clicks. We read statement lines, group them by reference, and link them to events from UPI, BBPS, and payout flows. You can see what matched and what needs review, with friendly labels that a finance analyst can trust. For each gap we suggest the likely cause, such as a late settlement or a wrong reference, and we keep the item open until the fix is done. The ledger stays clean, refunds are easy to trace, and finance can close the day on time without moving between sheets or chasing teams for files.

audit trail

Alerts roles and audit trail

Stay in control with simple rules and clear records. Set alerts for low balance, failed statement fetch, or unusual activity on any account. Pick who should receive each alert and how they should be notified. Use role based access to keep sensitive data limited to the right people, such as read only viewers for partners and full access for finance leaders. Every action is logged, including who fetched data, who changed a setting, and when a file was exported. The audit trail gives you peace of mind during reviews and makes external audits faster and less painful.

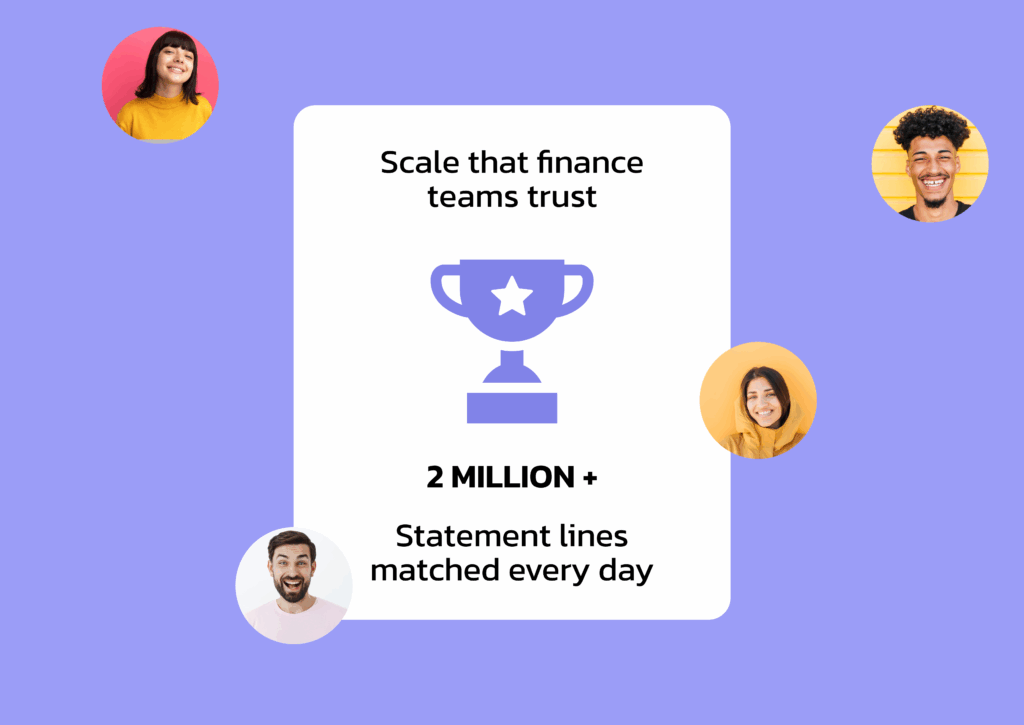

THE PROOF IS IN THE NUMBERS

Why Connected Banking changes the numbers

99%

Uptime for balance and statement fetch across linked banks

90% plus

Settlement lines auto matched for UPI payouts and BBPS

20 sec

Average time to pull a fresh statement and update dashboards

FAQ

FAQs about Connected Banking

Quick answers to common questions about setup security and day to day use.

You get one view of balances across many banks. You can pull statements on demand or on a schedule. You can match settlements for UPI payouts and BBPS. You can export clean files and use webhooks to push data to your system.

We support major banks in India. Share the accounts you want to link and our team will guide the setup. You choose which accounts to sync and you can add or remove banks anytime.

No. Connected Banking sits beside your payment stack. It reads balances and statements and helps finance reconcile faster. Your collection and payout flows continue as they are.

Data is encrypted in transit and at rest. You control access with roles. Finance can see balances and statements. Other teams can get limited access such as reports only. Every action is logged for audit.